Hedge Fund Investor Barometer

The 2025 Hedge Fund Investor Barometer reveals insights from over 200 investors on risks, opportunities, and the role of alternative investments in portfolio...

We rely on robust processes and strict hedge fund selection methodologies to offer access to competitive managers and innovative solutions.

By relying on our hedge fund platform, you benefit from:

Launch of the liquid alternative platform

in AuM1

dedicated investment professionals

Absolute return and attractive risk/reward profile

Our hedge funds investments seek to improve investment performance and minimize down risk exposure. They aim to generate uncorrelated returns to market risks based on managers’ ability to identify opportunities.

Portfolio diversification

Our hedge fund managers offer long and short exposure to a broad range of asset classes, regions, sectors, styles, factors or maturities.They implement uncorrelated investment strategies using different financial instruments and portfolio management techniques.

Access to experienced managers

Our selected managers have a long-standing trading and risk management experience and have the ability to manage complex strategies

We offer a wide range of hedge fund solutions spanning from off-the-shelf hedge fund strategies under a UCITS format to bespoke customized solutions.

Our offer is complemented by a wide range of advisory services tailored to our clients’ needs.

Our UCITS fund platform partners with high conviction managers selected for their experience and track-record in operating their offshore investment strategies.

We have nurtured privileged relationships with renowned names in the alternative segment, and have the structuring skillset and infrastructure to replicate these strategies in UCITS format.

Our selective range of strategies and high conviction managers:

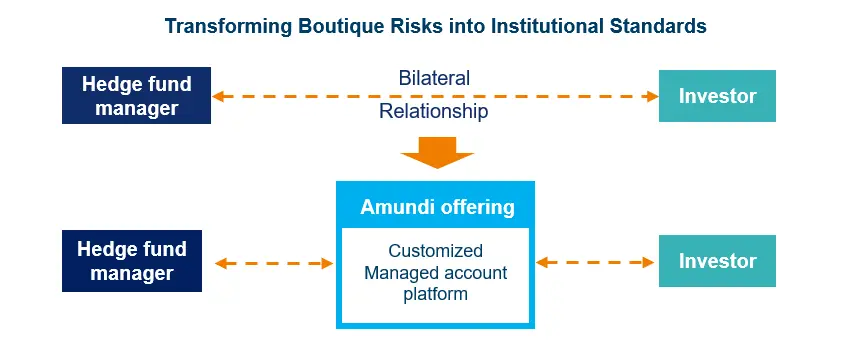

We take into account our client specific needs and investment constraints at multiple levels, providing them with:

Our dedicated managed account platform offers a secure investment framework for institutional and corporate clients based on performance enhancement and structural alpha.

We regularly share our in-depth hedge funds expertise with our clients to provide them with a greater access to:

1. Source: Amundi AM. figures as of 31/12/2024