Pension Funds Letter 21 - All together to talk “Adaptation i...

Get highlights from the Amundi World Investment Forum on adapting to tech trends, assessing geopolitical risks, and optimizing pension fund distributions...

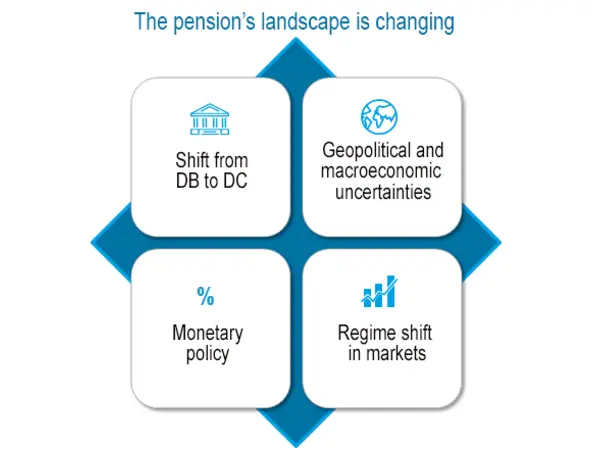

Navigating a complex retirement landscape

Meeting your long-term retirement objectives is made harder by a challenging market environment, ageing populations and ever-evolving regulation.

At the same time, geopolitical and climate change risks are increasing while macroeconomic uncertainty challenges traditional allocations.

We draw on our extensive global insights, resources and experience to support you in meeting these challenges through a complete and innovative asset management offering, tailored to all of your pension needs.

Explore below our effective solutions for all types of pension funds worldwide.

With a full-range of asset classes capabilities for pension funds, we are also specialists at integrating responsible investment across the entire pension value chain.

We offer a full range of investment solutions to meet the long-term needs of defined benefit (DB) pension funds:

We offer capabilities to support defined contribution (DC) schemes and your members in meeting industry challenges through a wide range of solutions:

As a dedicated partner to DB and DC plans, we can support you with advisory offerings and services across your pension fund’s whole value chain:

Our outsourced investment solutions team work with public and private pension funds across the globe to provide strategic advice and assist you in implementation. Our solutions platform aims to understand your distinct needs to:

We offer support on governance and strategy, asset allocation advisory, overlay management, asset or liability modelling and liability benchmark design.

Enhance your capabilities and achieve more impactful investment decisions with our ALTO Technology platforms. Our services offer for pension funds includes:

Enhance your quality of execution and scale your trading capacity with Amundi Intermediation. Our regulated entity is dedicated to best execution and one of the leading providers of buy-side outsourced dealing solutions for all asset classes and geographies.

Responsible investing is at the heart of our investment philosophy

We are committed to helping pension funds navigate the responsible investment landscape.

In addition to a comprehensive range of responsible investment and climate-based solutions, we offer ESG advice and services to support you in achieving your ESG goals:

As Europe’s largest asset manager by assets under management1 we’re a leading provider for pension funds.

Regions of client coverage: Europe, Asia, the Americas, and MEA1

individual pension fund clients2

in AuM2

Your partner in thought-leadership

The Amundi Investment Institute enhances strategic dialogue with clients and cements Amundi's leadership in economic and financial research:

Sharing our knowledge with you

Knowledge sharing is the foundation of our client relationships. We seek to address your specific investment challenges through:

1. Middle East and Africa. Source Amundi, as of end June 2024

2. Source Amundi, as of end June 2024